Unfortunately, I have been unable to obtain a recent, complete budget for the Industrial Development Authority of the County of Pima (IDA), for which Russo is essentially CEO. The IDA is considered independent of Pima County so it’s not part of their accounting and it’s a government entity so it does not file an IRS Form 990 for non-profit corporations.

I went to the IDA website and in an Excel spreadsheet added up all the bond amounts from 2001-2015 (there’s many more from before 2001) and found that the IDA received $3,248,709 over those years and is receiving that approximate amount every year. (The IDA receives .10% of the bond amount annually plus, large fees that cover the costs of the application and administration.) How does the IDA spend this money?

What kind of assets does the IDA have?

In 1993-94, The Industrial Development Authority of the County of Pima (“Pima IDA”) bought sixteen apartment complexes in Maricopa County, which had full cash values totaling $14,585,636 and claimed that they were exempt from ad valorem taxation because Pima IDA was a political subdivision of the state and, therefore, its property was “state” property, which is constitutionally exempted from taxation. The tax court upheld the tax and the Arizona Court of Appeals affirmed.

The Arizona Corporation Commission required primitive budgets whenever a Corporation filed its annual report. I found very strange budgets for the IDA from 1995 to 2007, which didn’t change much or show any large assets like those, above.

When County Supervisor Reg T. Morrison lost his seat in 1992, he became Treasurer and a Director of the IDA.

SUPPORT THE AFFORDABLE HOUSING AND ECONOMIC DEVELOPMENT PURPOSES AND ACTIVITIES OF THE INDUSTRIAL DEVELOPMENT AUTHORITY OF THE COUNTY OF PIMA SALT PURCHASES AND REHABILITATES HOMES TO SELL OR RENT TO LOW-TO-MODERATE INCOME RESIDENTS OF PIMA COUNTY

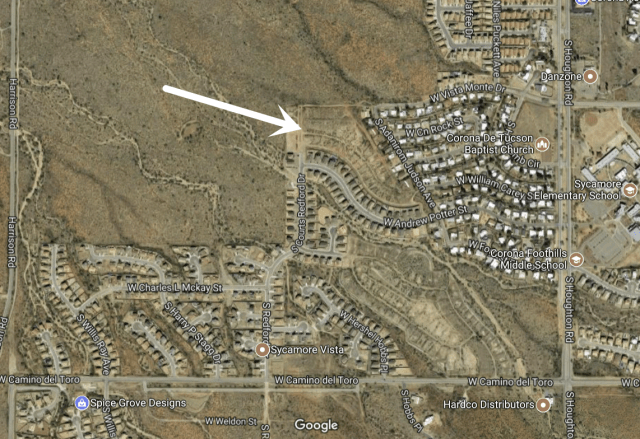

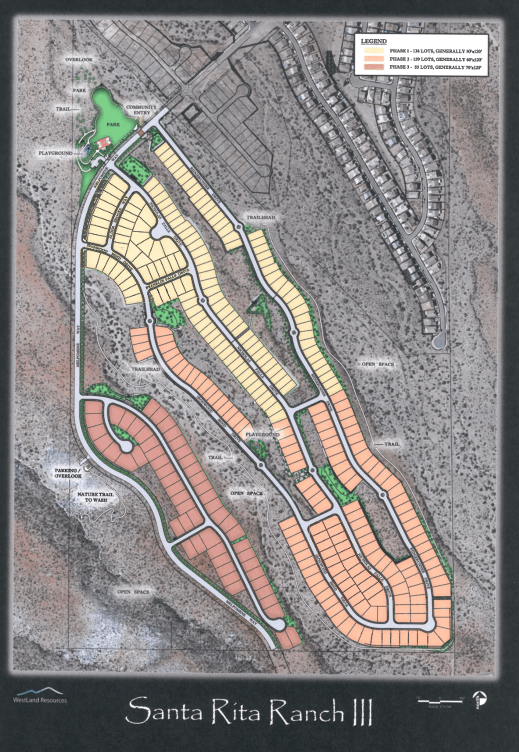

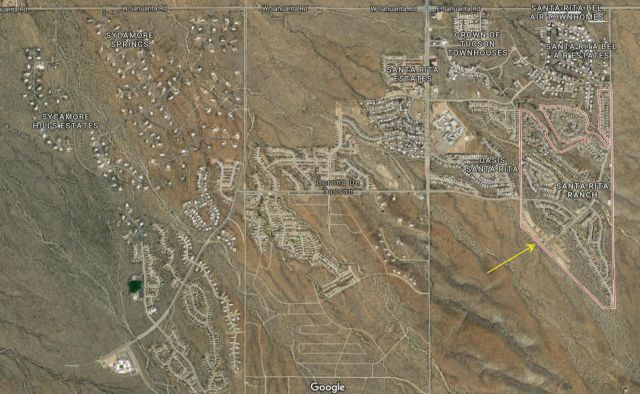

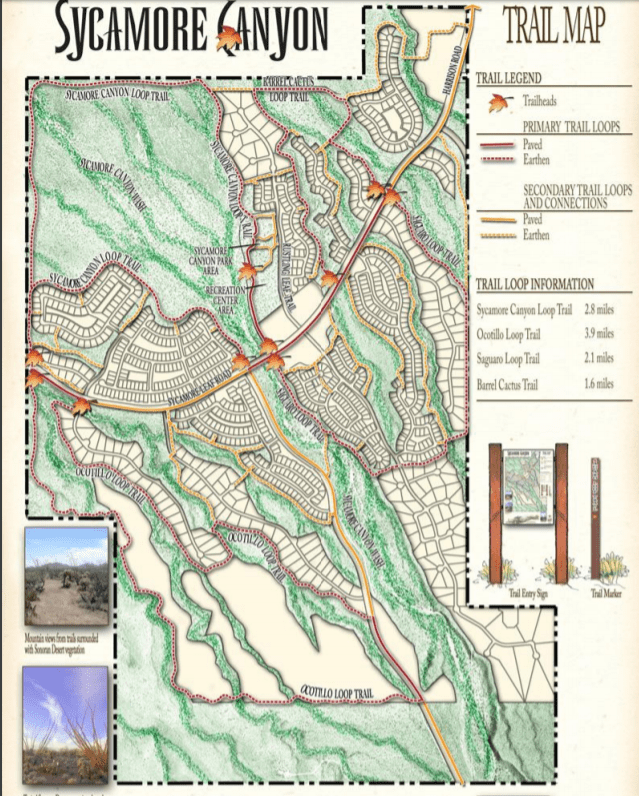

Gross receipts $923,231 / Bob Schwartz (Russo attorney), CEO, 40hrs/wk, $86,949 (no time for other legal work?); Paul Sorenson (worked as chief financial officer for the prior majority lot owners in Sycamore Vista, which ended up causing National Bank of Arizona to lose $32-million!), COO, 40hrs/wk, $88,294 / Family Housing Resources, Independent Contractor received $333,596 in compensation / Management $86,208, Legal $7,348 / Loans from IDA $2,053,214

Gross receipts $6,250,680 / Russo, Russo & Slania, PC, Independent Contractor $125,567 / Management $69,038, Legal $90,442 / Forgiven loans $2,000,000

Gross receipts $4,233,400 / Russo, Russo & Slania, PC, Independent Contractor $131,000 / Management $81,830, Legal $127,147

CIC PROVIDED LOANS AND FINANCIAL ASSISTANCE TO BUSINESSES WITHIN PIMA COUNTY THAT WERE UNABLE TO OBTAIN SUCH THROUGH TRADITIONAL SOURCES LOANS WERE MADE ON THE BASIS OF PUBLIC PURPOSE FOR BUSINESSES AND EMPLOYMENT RETENTION/CREATION CIC ALSO PROVIDED SUPPORT SERVICES TO THE INDUSTRIAL DEVELOPMENT AUTHORITY OF THE COUNTY OF PIMA CIC ALSO PROVIDED BUSINESS START UP ASSISTANCE INCLUDING SEED MONEY TO START UP BUSINESSES CIC ADMINISTRATED THE CHARTER SCHOOL COMPLIANCE FOR BONDS ISSUED BY VARIOUS DEVELOPMENT AUTHORITIES CIC PROVIDED FISCAL AGENT SERVICES TO TUCSON AND PIMA COUNTY FOR THEIR DOWN PAYMENT ASSISTANCE PROGRAM

Gross receipts $1,674,986 / Frank Valenzuela, Executive Director (also serves on the IDA), 40hrs/wk $123,400 / Other salaries & wages $223,603 / Revenue from: Charter School Loan Adm $318,965 / Legal $53,529 / Bad debt (expense writeoff) $452,955 / PTHS due (liability) to IDAS (of Pima County, IDA plural?) $540,639

NOTE: Russo is not mentioned this year but in 2011, below.

Gross receipts $1,666,088 / Frank Valenzuela, Executive Director (also serves on the IDA), 40hrs/wk $121,128 / Other salaries & wages $174,985 / Revenue from: Charter School Loan Adm $316,617 / Legal $54,493 / Bad debt (expense writeoff) $162,491 / Exchange of assets with IDA Pima County $72,000

NOTE: Russo is not mentioned this year but in 2011, below.

Gross receipts $2,370,896 / Frank Valenzuela, Executive Director (also serves on the IDA), 40hrs/wk $141,481 / Russo, Russo & Slania, PC, Independent Contractor $114,000 / Other salaries & wages $129,000 / Revenue from: Charter School Loan Adm $304,464 / Legal $110,911 / Bad debt (expense writeoff) $110,440 / Performance of services with IDA of Pima County $87,000

Similar local non-profits

- Pima County Community Land Trust 2013

Gross receipts $ 1,920,075 / Legal $6,593 / Management $0.00

- Primavara Foundation 2013

Gross receipts $10,206,438 / Legal $0.00 / Management $0.00

- Old Pueblo Community Services 2013

Gross receipts $5,293,242 / Legal $4,775 / Management $0.00

- Habitat for Humanity 2013

Gross receipts $6,943,227 / Legal $15,463 / Management $0.00

My next blog post will be about the IDA selling bonds to fund charter schools — most of which aren’t in Pima County and whether or not the Board of Supervisors should approve those IDA bonds.

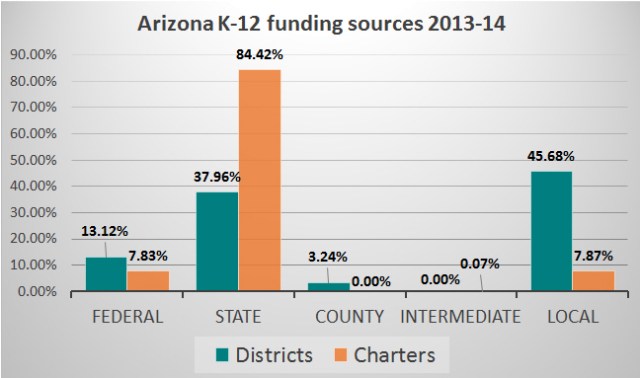

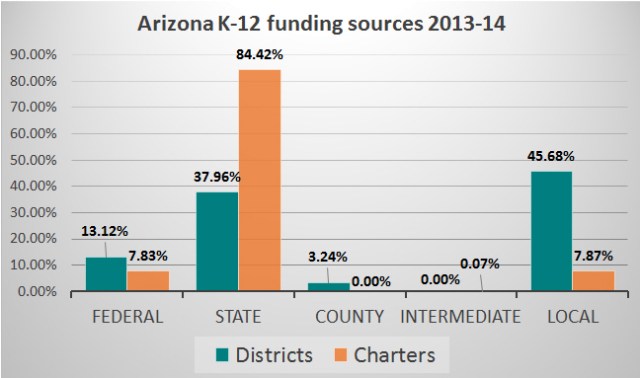

84% of charter school funding comes from the State, vote NO on Prop 123!